Savings

Savings Accounts

What's the reason you're saving? Whether it's a vacation, wedding, baby or a rainy day, a savings account at GreenState is a safe place to store your money. Dividends are paid monthly, and you can easily transfer funds to or from your GreenState or external bank account.

To open a new savings account or add additional accounts to your existing membership, you can stop by any branch location, give us a call at (800) 475-6728, or:

Open an Account Online in Minutes

Hoppy's Kids Club

The GreenState Credit Union Kids Club is an educational, fun club designed to teach kids 10 and under about the value of saving money.

To sign up, give us a call at 1-800-397-3790 or stop by any GreenState office!

Saving Tips

Use separate savings accounts for different goals.

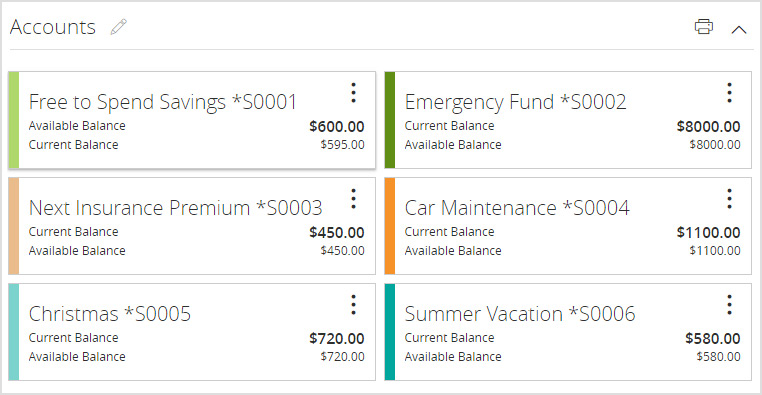

Did you know you can open more than one savings account with your GreenState membership? Separate savings accounts can help bring your goals into focus when you give each account a name in online banking:

Example of named savings account in GreenState online banking.

Pay yourself first with recurring transfers to savings.

Automate your good savings habit in just minutes with a recurring funds transfer in online banking. Choose an amount and frequency that fits your needs and start building your savings with ease. Learn how to setup an a recurring transfer in online banking and put your savings on autopilot today.

Rainy Day Savings

One of the best ways to build financial security is to have enough in savings to handle emergencies that may come your way. GreenState's Rainy Day Savings Account helps make building an emergency savings fund so easy you don’t even need to think about it!

Commercial Money Markets

Business deposit accounts can also benefit from the higher returns and flexibility of a money market account. We offer a business Green Account as well as a specially priced Partner Money Market Account for organizations that partner with the credit union.

† If you find a better advertised yield on a Certificate or IRA at a financial institution based in the counties we serve, GreenState will beat it. Guarantee available for a limited time only. Applies only to Certificates or IRAs with comparable terms and conditions. Does not apply in those cases where the credit union does not offer a comparable product. Not available to public organizations or other financial institutions. Maximums apply.